The success of an e-commerce business depends on various factors, and one of the crucial elements is the seamless processing of payments.

In this article, we will explore the importance of payment gateways for e-commerce businesses and how they can help prevent cart abandonment, reduce customer frustration and increase liquidity.

Payment gateways: a basic explanation

Before we dive deeper into the subject, let’s take a look at what payment gateways actually are.

A payment gateway is a technology that enables the transmission of information between a payment gateway website and the merchant’s bank.

It plays a crucial role in the processing of online payments, ensuring security and efficiency.

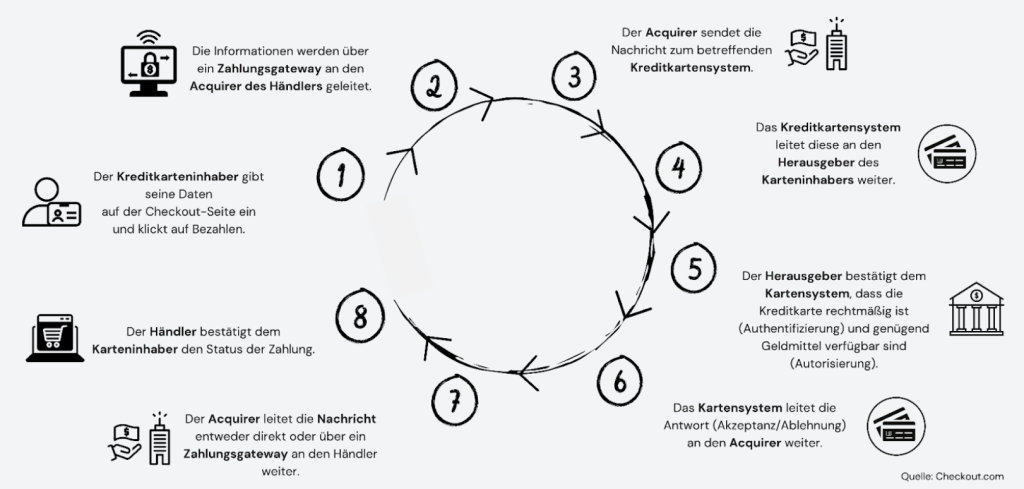

Several key players are involved in a credit card transaction in e-commerce.

Here are the main parties involved:

1st customer

The end user who shops online and uses their credit card for payment.

2nd dealer

The seller who offers the goods or services and accepts the payment.

The merchant works with the acquiring bank to process payments.

3. payment gateway

Mediates between the merchant, the customer and the financial institutions.

Ensures that the transaction is secure and efficient.

4. acquiring bank (merchant bank):

The bank with which the merchant has an account.

It receives the authorized transactions and transfers the funds to the merchant’s account.

5. publisher (Issuer)

The bank that issued the credit card to the customer.

This bank checks the availability of funds and authorizes or declines the transaction based on the customer’s credit limit.

6. credit card system

Visa, Mastercard, American Express, etc. These companies issue the credit cards and monitor the entire transaction process.

Each of these players plays an important role in the credit card transaction process

in e-commerce.

The interaction and cooperation between these parties ensures a smooth and secure payment process for the customer and the merchant.

Avoidance of shopping cart abandonment

1. convenient payment options

One of the main reasons for shopping cart abandonment is customer dissatisfaction with the payment methods offered.

Payment gateways offer a wide range of options, including credit cards, debit cards, digital wallets and more.

This allows customers to choose the method that is most convenient for them, which reduces the likelihood of shopping cart abandonment.

2. fast and reliable transactions

By integrating efficient payment gateways, online retailers can ensure that transactions are processed quickly and reliably.

Long waiting times or aborted transactions can frustrate customers and cause them to abandon the purchase process.

Strengthen customer confidence

3. security and data protection

Payment gateways are equipped with advanced security protocols that protect customers’ sensitive information.

Ensuring data protection and security during the payment process strengthens customer confidence in the e-commerce platform.

4. global acceptance

Another advantage of payment gateways is their ability to process different currencies and international transactions.

This is especially important for e-commerce companies operating in the global market.

Customers feel more comfortable when they can use their preferred currency.

Optimization of liquidity

5. faster payment approval

By using efficient payment gateways, e-commerce merchants can speed up the payment approval process.

This leads to improved liquidity, as companies can access their revenue faster.

6 Automated payment processes

Modern payment gateways also offer the possibility of automating payment processes.

By defining payment schedules and recurring payments, companies can better plan and manage their liquidity.

Choosing the right payment gateway

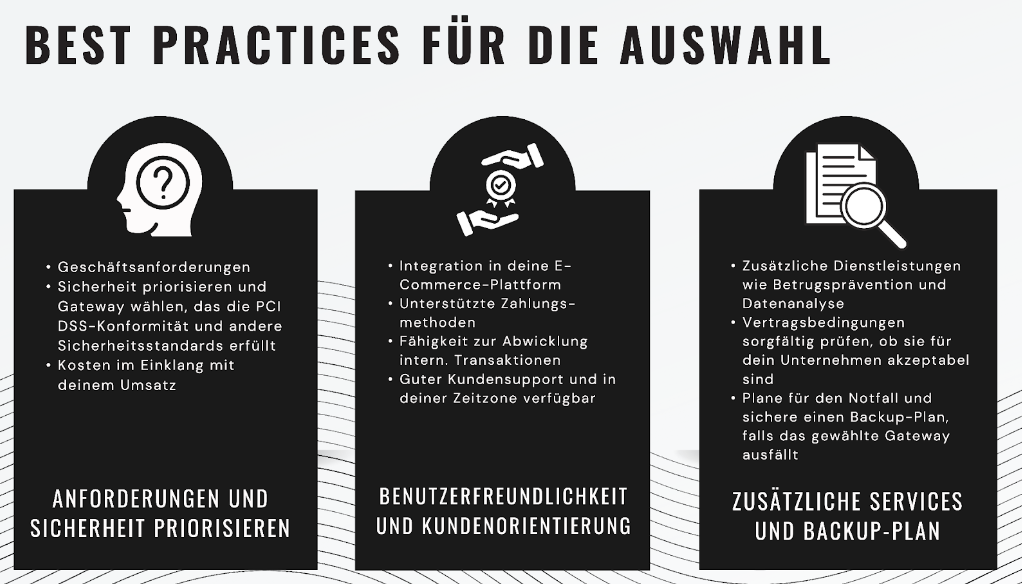

These three strategic steps will help you choose a suitable payment gateway that meets the needs of your business while ensuring security, ease of use and efficiency.

Prioritize requirements and security

- Analyze your business requirements, including accepted payment methods and international presence.

- Prioritize security and choose a gateway that meets PCI DSS compliance and other security standards.

- Make sure that the costs are in line with your turnover.

User-friendliness and customer orientation

- Check the integration into your e-commerce platform and the user-friendliness for customers.

- Make sure that the provider offers good customer support and is available in your time zone.

- Pay attention to the supported payment methods and the ability to process international transactions.

Additional services and backup plan

- Investigate whether the gateway offers additional services such as fraud prevention and data analysis that could be useful to your business.

- Check the terms of the contract carefully and consider whether they are acceptable for your company.

- Plan for emergencies and secure a backup plan in case the selected gateway fails.

About Lady FinTech

Website:

www.lady-fintech.com

Janine has over 7 years of experience in online payments and over a decade in the European financial industry.

Having previously worked as a risk analyst, key account manager, consultant, sales manager and division manager, she has excellent market awareness, analytical skills, efficient communication skills and strong financial knowledge.

She has a degree in business administration.