In today’s digital business world, choosing the right payment provider is critical to a company’s success.

However, with the variety of options available and the different needs of each business, choosing one can quickly become a challenging task.

From cost to variety of payment options to data security, there are numerous factors to consider.

A well-thought-out decision can not only increase efficiency and customer satisfaction, but also boost sales and security.

This guide can help you identify the most important criteria and avoid common mistakes in order to choose the best payment provider for your business.

Variety of payment options

Today’s customers expect a wide range of payment options.

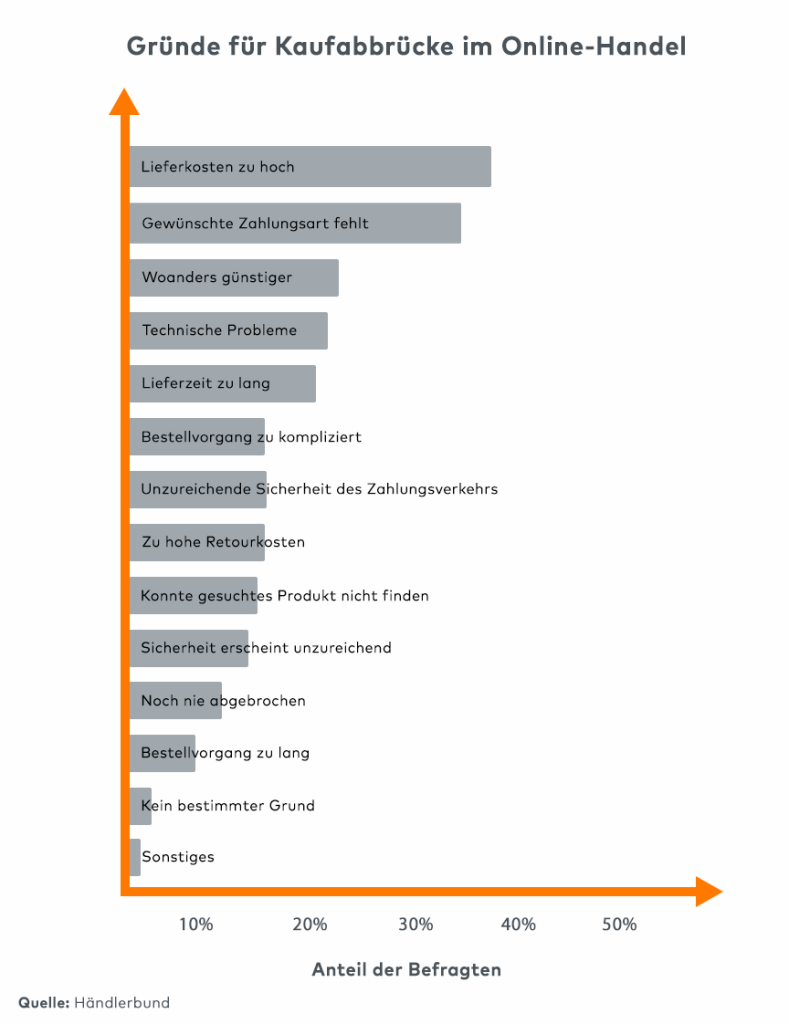

If a store does not meet these requirements, this can lead to abandoned purchases and have a negative impact on sales.

It is therefore important to choose a payment provider that supports a wide range of payment options.

PayPal Checkout gives you an effective all-in-one payment processing solution to drive more sales and conversions by allowing you to accept multiple payment methods online and in-store:

- PayPal Wallet

- PayPal installment payment or payment after 30 days1

- Credit cards

- Debit cards

- Apple Pay

- Google PayTM

International sales

Another point is that supporting local payment methods is particularly important for internationally operating companies.

Different payment methods are preferred in different regions.

For example, in some countries credit cards are the preferred payment method, while in other countries digital wallets or bank transfers are more popular.

A payment provider that supports these local preferences can help companies expand their reach and effectively tap into new markets.

Did you know?

International online stores that accept PayPal, in contrast to online stores that do not offer PayPal payments, record an average increase in sales of 146%.²

Simplicity of integration

In addition to supporting different payment options, the seamless integration of these options into the checkout process is also crucial.

The payment process should be simple and user-friendly to ensure a smooth and pleasant experience for the customer.

A well-integrated payment platform minimizes hurdles and allows the customer to pay quickly and securely.

At the same time, the payment provider should be able to connect seamlessly with the selected store system.

Thanks to the partnership between collana pay and PayPal, we have succeeded in creating a smooth integration that can be activated quickly and easily.

Transaction management

Managing all payments in one place gives you more control over your transaction data.

With the all-in-one PayPal Checkout solution, you get an overview of all transactions, sales and reports in one dashboard.

This allows you to better manage your cash flow and transfer money immediately to your PayPal business account.

Security and risk management

Security is another crucial factor.

Data breaches and card fraud can not only damage a company’s reputation, but also lead to significant financial losses.

A secure payment provider that proactively prevents fraud and complies with PCI DSS standards is therefore essential.

A reliable payment gateway and a provider that has integrated robust security measures can strengthen customer trust and minimize the risk of fraud.

Did you know?

79% of PayPal users surveyed are convinced that PayPal protects them from fraud.4

Because PayPal’s fraud and seller protection tools for eligible transactions ensure that you can focus on your business instead of worrying about fraud.

Fraud protection covers card payments and digital wallets.

With Seller Protection³, you’re also covered for PayPal payment methods for eligible transactions.

Conclusion

Choosing the right payment service provider requires thorough analysis and careful consideration.

The cost structure, the variety of payment methods offered and the security measures are decisive factors that can contribute significantly to the success of your company.

It is important to pay attention not only to the fees, but also to the quality of the support and the technical capabilities of the provider.

By avoiding common mistakes, such as neglecting security aspects or overestimating low fees, you can ensure that you choose a payment provider that meets your business needs and satisfies your customers.

A well-thought-out selection will not only increase the efficiency of your payment processes, but also build trust with your customers, contributing to the long-term growth and success of your business.

Steffen Joniak

Senior Manager Partner Business Development

sjoniak@paypal.com / Linkedin